Identity theft and bank fraud are stressful and mortifying things to happen. Suddenly someone’s wrongdoing become your living nightmare and the burden of recovering your money back ASAP takes over your life. It’s an awful thing to happen at any point in your life, but imagine it happening whilst your on the other side of the world with very little internet and won’t be returning back home for another 3 months…

Unfortunately for Michael and I, we don’t have to imagine it, because this actually happened to us when we were just one month in to our Round the World trip.

It was our last day in Australia before heading to New Zealand, we were just about to enter the Blue Mountains National Park when Michael got a text from his bank that had a mini statement saying he had spent money in ASDA a couple of days ago. Straight away this rang alarm bells because we had been out of the country for a month so there was no way he was spending money in an ASDA in the UK. Back then Vodafone used to charge to roam when you were anywhere abroad so we had to pay £5 to use data to get online to find the bank’s phone number to report fraud. After giving his security information he reported the fraudulent activity and they assured him the card had been blocked from use and that his remaining money will be protected whilst they looked into it.

The next day however, he called from NZ to check on the progress only to find out that the block was not in place and all of his money had gone. It took our whole road trip from Auckland down to Wellington – lasting about one month – of endless phone calls (most of which were either on hold for hours or disconnected altogether) before we found out that they had spent his money in stores, got cash back, changed all of his personal information (which then made it nearly impossible for Michael to get through to someone on the phone because he couldn’t prove his identity), added an extra person to the account and then cleared out the whole account.

Eventually, after two very stressful months and a whopper of a phone bill he got his money back.

Anyway, horror story aside, here are eight simple pointers for keeping your travel money safe whilst you’re abroad and how you can be prepared should something happen to it:

1. Write a budget

Whilst planning our Round the World trip, I made a spreadsheet that had the cost of every excursion and activity that we were doing, along with a rough food estimate, hotel prices and an allowance for shopping, souvenirs etc. From this spreadsheet I was able to calculate a rough budget for each destination so I could divide up all the money we had accordingly.

I now do this for every trip we make. Having a budget means you know how much money to put away, and it helps prevent you from spending more money than you anticipated. When budgeting I always round up and allow a little wiggle room because you’ll never know exactly how much you’re going to spend. Plus this way you have a chance to save money as you go.

2. Stash your cash in different places

Split your physical cash into different compartments across your luggage, so if something gets stolen, all of your money won’t be gone.

I usually split cash between my purse, my travel wallet (which are both in my hand luggage) then in two different purses in both sides of my suitcase. If I’m carrying a second piece of hand luggage I will put one of the suitcase purses in that instead.

True Story: Many years ago Michael once went on holiday with someone who was scared of leaving his money in the hotel room, so he kept every penny of it on him. On their first night out, he went to the toilet and got mugged, losing all of his money in less than 24 hours after arriving. Obviously I can’t imagine any of you would do something as daft as this, but it’s a good example of what can happen if you don’t divide up your money.

3. Split your money across bank accounts

Similar to above but this time it’s the money in your bank as opposed to your physical cash.

When we were gearing up to embark upon our Round the World trip in 2016, we split up our money across eight different bank accounts:

X2 STA cash card

X2 STA Eccount

X2 Debit Card (different banks)

X2 Savings Account (different banks)

Along with all of the above, I also had my credit card and I changed up about £20 in each of the seven currencies we needed, so we had taxi money to hand. Eight might seem a bit excessive but we were going away for 4 months and wanted to be safe. As you’ll have read above though, unfortunately you can never be too careful, but just imagine how stuck we would have been if most, if not all, our money was in that one account that got drained?

4. Learn your exchange rates

Know the exchange rates before you go away, this will save you from doing tricky maths with your fingers or wacking out your phone calculator before purchasing something. I always check what £1 and £5 is in the currency of the country I’m going to. I have found I can work out the price of something just from knowing these two. This is especially helpful if you’re bartering and don’t have time to work out the price with a calculator. It also helps to stop you from getting ripped off if you already have an idea of what something costs.

5. Get to know the money

Familiarise yourself with the currency so you know what you’re handing over. Take a look at the sizes of the notes and coins, look for identifying pictures or colours. For example, our fivers are small and green but our £20 notes are much bigger and purple. US dollars might all be green but they can be identified by the presidents on them, and each of the Australian quantities have individual colour schemes.

By familiarising yourself with the money you are already taking away one big tourist give away. It makes it easier and quicker to pay if you know what you’re handing over, plus haggling prices on markets is far less awkward if you know what you’re dealing with.

PFH Top Tip: Fold your notes separately in your purse/wallet and organise them by value so you aren’t pulling out a wad of cash wherever you are when you need to spend it.

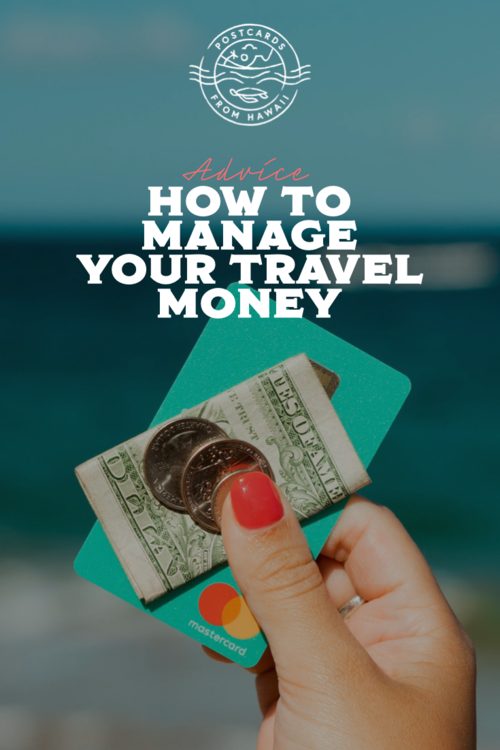

6. Consider a travel card

Travel cards are managed solely online are becoming increasingly popular and are a great way to manage your travel money.

My first one was the STA cash card, we were given it for free as we were booking such a big trip with them. At first it seemed like a great idea because it’s a MasterCard that you can pay with and withdraw money from for free when you’re abroad. I didn’t like using it though because the online log in is very complicated, it takes a minimum of four working days for your money to be deposited into the eccount, they charge you to look at your balance at any cashpoint and unless you are spending a large amount of money with them you have to buy the card.

I now use Monzo (yeah these are the guys with the very popular orange card) and Starling. I much prefer to use Monzo and Starling now because:

They have very easy to use apps which are password protected.

The apps have the option to make your own digital piggy banks for your different saving goals.

You don’t get charged to spend your money abroad.

Transfers are virtually immediate.

You get a notification as soon as you spend money, provided you’re online.

Unlike STA you can transfer money out of their accounts.

Extra bonus, they both have a really nice design and chances are you will be complimented for the colour of your card when you use it!

PFH Top Tip: Apply for Monzo and Starling as soon as possible and not just before your trip because they are in high demand and have a long waiting list. Monzo members are allowed to shortlist someone though so check to see if anyone you know has one.

7. Apply for a credit card

They aren’t necessary should you not want to or aren’t able to get one, but there are great benefits to getting a credit card for your travels:

Credit cards are like a safety net for your expenses should something go wrong.

Hotels require a bank card for incidentals (room service, mini bar etc.), some can be funny about accepting debit cards and prefer credit card.

Not all car rental companies will take debit cards and if they do, chances are they will carry out a credit check. Holding a credit card shows that you’re not a credit risk. You will find most rental companies will only take a credit card as insurance should you not return the car.

Some credit cards come with travel perks such as travel insurance, lounge access, hotel upgrades etc. It’s worth doing some research into the different companies depending on your style of travel.

PFH Top Tip: I recommend pre paying for your holiday – flights, hotel etc – with your credit card because should the company go bust before or during, you are protected by the Consumer Credit Act. This means the credit card company has equal liability should you not receive the service you’ve paid for. It’s added protection for your money.

Pay off your CC as soon as possible to protect your credit score. Remember it’s the bank’s money, not yours so don’t let the debt pile up, they should just be considered a back up plan in case of a problem.

8. Be prepared

When the fraudulent activity happened with Michael’s bank account, the people who did it had managed to change all of his personal information which then made it near on impossible for Michael to prove his identity over the phone and get his money back. For this reason I strongly recommend you name a trusted family member on your bank account, so that if anything goes wrong whilst you’re away, they can go in to your local branch and fix the problem with someone in person.

There’s not a whole lot of point in adding someone for smaller trips and holidays as it won’t be long before you will be home and therefore able to go into the bank yourself, but if you are travelling for a long time or moving abroad, I highly recommend you do it.

Either way, you should definitely write down or save the phone number for reporting fraud to your bank before you go, so that you don’t have to worry about getting online to find it. You can find the helpline on the back of your bank card but save it somewhere else in case you lose your card.

.

What I can say from this experience is no matter how careful you are, you really can’t prevent some things from happening, but these eight tips will help you to be safer and more efficient with your travel money.

.

Aloha, Gabriella